January 1st is in the past and we are already a week into 2021. Did you make a New Year’s Resolution that you have already not kept? Or are you still following through with your resolution?

We see often hear of resolutions attempting to improve your health by beginning to exercise, losing weight, or stopping smoking. Just as many individuals are setting financial resolutions – from getting out of debt to having the funds for a significant purchase or starting to save more, these financial resolutions are the ones that we want to provide some ideas on how to make happen.

First, some ideas if you are struggling with debt:

- You cannot borrow your way out of debt. Time and studies have shown consolidation loans do not work. More often than not, people do the consolidation loan and run the credit cards back up again. Now, they have to pay both. Our first recommendation is to go to cash for your spending. Until the debt is under control, no adding any new debt. Put the credit cards away in a drawer, or some even freeze them in ice to prevent using them. Retrain your brain only to use them in the case of an emergency. The same may need to happen to your debit or ATM card if you feel you cannot use it responsibly. There is something to be said about our grandparents’ envelope system and paying as you go.

- The likelihood of getting out of debt increases if you are also saving at the same time. Applying all available funds to your debt may seem the appropriate thing to do, but it means you do not have the funds to withstand an unexpected event. If you have extra money before applying it all to your debt, take ½ and create an emergency fund for yourself. Continue doing this until you have 3-6 months of living expenses in that emergency fund. This means if you have an unexpected car repair or medical bill, you have the funds to pay it and are not adding to the debt. It can be a never-ending cycle of getting the debt paid down, an emergency occurring, increasing debt, working on paying down debt, an emergency occurring, and the cycle continues. Break the cycle by knowing you have the funds to handle many of the financial emergencies that come into our lives regularly in an emergency savings account.

- Take advantage of the snowball effect when paying down debt. Lock in all your minimum payments to what they are today except for one loan. Concentrate all extra payments on that loan. When that loan is paid off, take the original payment amount plus the extra you have been paying and apply it all to the 2nd If you keep adding loan payments as extra payments when a loan gets paid off, it is like that small snowball rolling down a hill, becoming bigger and bigger. Which loan to pay off first? If you need the satisfaction of getting a loan paid off, take the one with the smallest balance and get that paid off first. Your other option is to pay the extra on the one with the highest interest rate to pay it off first since that costs you the most money to carry.

A second resolution may be to increase savings. We believe the key here is to put it on automatic. Many individuals say they will put whatever is left at the end of the month into savings. Use the adage of “pay yourself first.” Set up to have funds go directly from your paycheck into a savings account. Set up an automatic transfer of funds to go directly from your checking account to your savings account the day after receiving your retirement distribution.

The automatic is the first part. The 2nd part is using your savings responsibly. If you put money in savings only to take it out a day or two later, it will not serve its purpose. This is part of why we advocate multiple savings accounts, with each one having its purpose. Some standard accounts are for vehicle expenses, property or income taxes, annual insurance premiums, vacations, home improvements, weddings, or college expenses.

What is it that you want to do in the future that you need or want to start saving for now? At one point, I had a savings account to purchase a new motorcycle. We have several family members saving today for a trip to Ireland in four years. I also have an account that will fund my property and school taxes each year. This is the purpose of Christmas Club accounts. Even if an account only gets $10 a month to start, the act of starting to save will keep that need or want in your thoughts.

Many banks and credit unions allow you to name your savings accounts to know what the funds are for. If you find yourself taking funds out of those accounts for other than the intended purpose, maybe you need to make it more difficult to access those funds. Do not use the bank that you typically bank with. Use an online bank to make it more difficult to access those funds. Do not have an ATM or debit card for this account; know that you must go into the bank during open business hours to access the funds. Whatever it takes to make sure that you leave these funds alone except for their intended purpose.

Setting up and automating the funding of your savings accounts and your debt payments will help decrease the time that you need to spend managing your finances, can potentially decrease late charges, and helps you stay on track. If you know that you want to save $3000 for a vacation this year, set it up to put $250 a month into your vacation fund or $115 a paycheck if you get paid bi-weekly. This means at the end of the year, you will have your $3000. Think about how much more enjoyable a vacation could be if you know it is paid for and you are not coming home to the pile of debt that occurred on vacation.

Finally, I want to suggest a resolution that you probably did not think of. Plan a weekly financial meeting. The act of reviewing and paying attention to your finances, even for an hour a week, can make a substantial difference over a year. I am not talking about the time you spend paying your bills; we are thinking about how to improve your use of money. What to do during these meetings? First and foremost, set up the savings accounts we just discussed and get your debt repayment schedule in place. Some other suggestions once you have done that:

- Review your regular, routine bills and see if there are ways to reduce them. Are there ways to save on your auto, homeowner, or life insurance premiums? Can you decrease the cost of your cell phone or cable bills? Will buying a programmable thermostat help you decrease your electric or gas bill? Are there ways to decrease your grocery bill that you are willing to implement? Does refinancing debt make sense for lower interest rates?

- Look at your long-term financial goals. Are you on track to meet them? If not, what needs to be done to get you on track? That could be a goal of retiring at 60. Would it be the resources to send a child to college or for a wedding? It could be figuring out the cost of that dream vacation or spending time in warmer weather during the cold winter season. Sometimes planning for these goals gets forgotten while you are managing more immediate needs and wants. Keeping them in your thoughts gives you a much better chance of succeeding.

- Discussing finances and money with a partner and with children is essential. Learning where money thoughts come from can help with managing money today. What makes one person be a spender and one be a saver? Does one person have a scarcity fear that they need help in managing? Is there a concern about how money is being spent? What do you see as the purpose of money? What do you want to teach your children about handling it? These types of discussions can help prevent fights about money, the leading cause of divorce.

Money plays a significant role in our lives. For those that feel they do not have enough, it is a constant worry about how to get more. For those that feel they have enough today, the worry is often about having enough in the future. Both can be helped by paying attention and planning. Watch one less television show, spend a little less time on social media or video games, get up an hour earlier one day a week to find the time. We spend so much of our time earning money. Make sure you are maximizing how you use and save it.

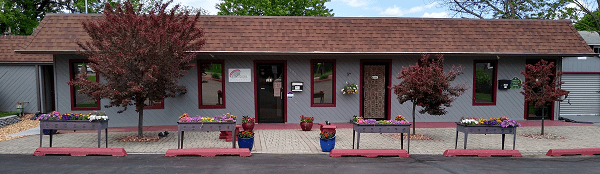

If you need help, we are certainly full of ideas at Planning with Purpose. Come in for a few hours of consultation or decide to become part of our financial coaching program. There are many resources available on the Internet or at your local bookstore. Do not let a lack of knowledge prevent you from having a financially secure future.